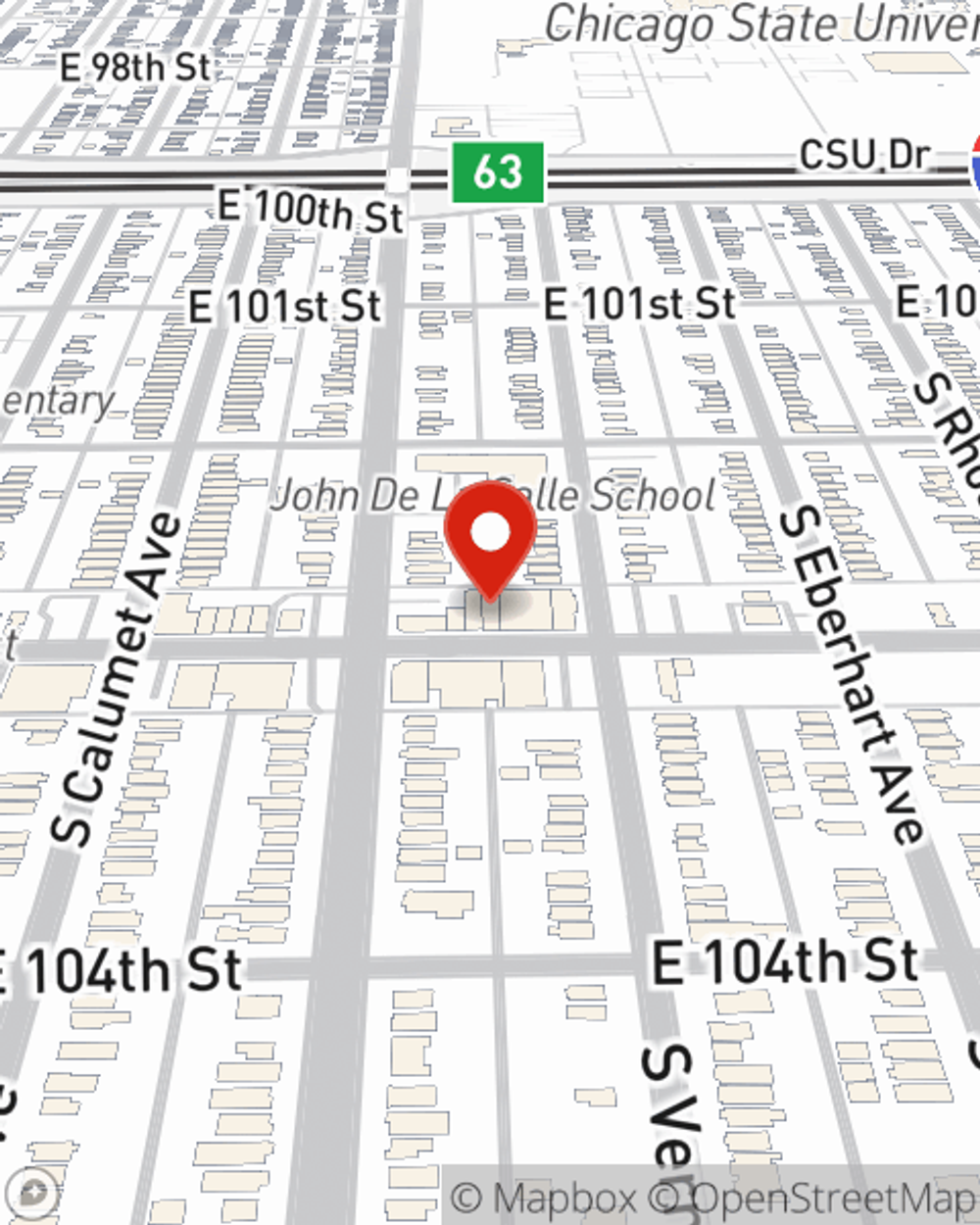

Business Insurance in and around Chicago

Get your Chicago business covered, right here!

No funny business here

Your Search For Outstanding Small Business Insurance Ends Now.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Win Walker help you learn about great business insurance.

Get your Chicago business covered, right here!

No funny business here

Insurance Designed For Small Business

If you're looking for a business policy that can help cover extra expense, accounts receivable, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

At State Farm agent Win Walker's office, it's our business to help insure yours. Call or email our wonderful team to get started today!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Win Walker

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.